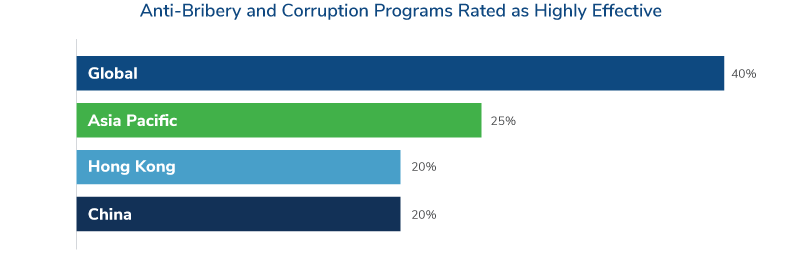

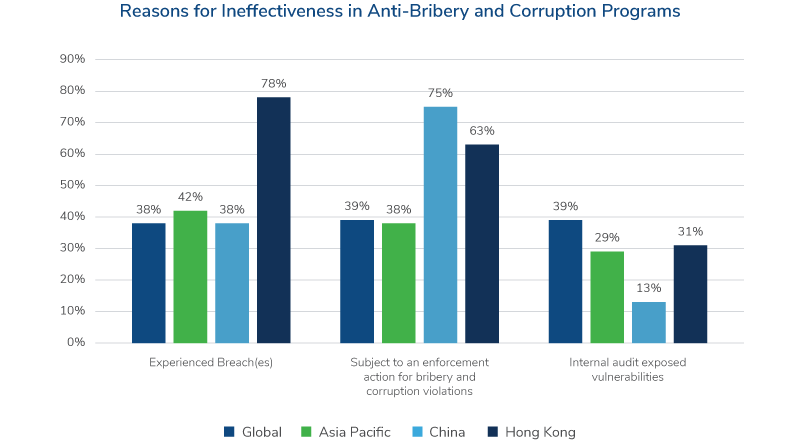

In Kroll’s analysis of their recent anti-bribery and corruption (ABC) survey data in 2022, nearly 70% of respondents in the Hong Kong Special Administrative Region of the People’s Republic of China (HKSAR or Hong Kong) and People’s Republic of China (China) have either experienced enforcement action or identified breaches for bribery and corruption, when respondents reported their compliance program as ineffective or neutral. As a result, when assessing the effectiveness of ABC programs, nearly 25% of respondents in the Asia Pacific region assessed their programs as very effective, which is the lowest when compared globally (40%). The low percentage of effective ABC programs in Asia Pacific may be caused by the higher percentage enforcement actions or identified breaches for ABC in HKSAR and China.

Also, internal audits play a key role in the effectiveness of ABC programs. However, only 13% of respondents in China had internal audit-exposed vulnerabilities, which is considerably lower than the global average (39%). Given the ongoing emphasis on the evaluation of corporate compliance programs, compliance professionals and internal auditors should strive to hold greater responsibilities going forward.

Regulatory Fines in Asia Pacific and Compliance Programs

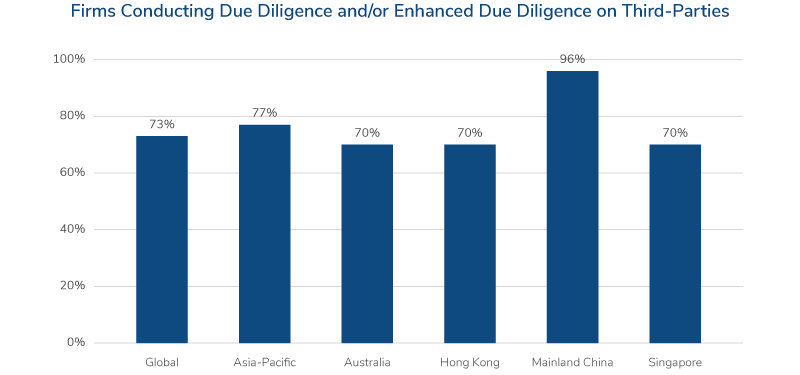

The Asia Pacific region continues to see enforcement actions by the U.S. Securities and Exchange Commission (SEC). This aligns with Kroll’s analysis of survey data in 2022, in which a majority of respondents in Hong Kong and China stated that breaches for bribery and corruption were experienced. Also, in order to mitigate the highlighted bribery and corruption risk, nearly 90% of respondents in China reported conducting due diligence and/or enhanced due diligence on third parties.

Third-party intermediaries were often utilized to engage with foreign officials, as shown in the recent SEC enforcement action cases in Asia Pacific. This demonstrates that third-party risk due diligence is an important component of ABC programs in order to mitigate bribery and corruption risk.

The Asia Pacific enforcement action case place emphasis on evaluating corporate compliance programs in order to enhance the books and records and internal accounting controls provisions of the U.S. Foreign Corrupt Practices Act (FCPA) requirement. Specifically, processes of third-party management and due diligence would be key to tackling the root cause of this phenomenon in order to mitigative bribery and corruption risk. The details of the processes have already formed part of an earlier-released, updated June 2020 guideline on the evaluation of Corporate Compliance Programs issued by the U.S. Department of Justice (DOJ)1

In Kroll’s analysis of survey data in 2022, 71% of respondents in Hong Kong utilize third-party screening to manage risks of third parties, which is the highest when compared globally (47%). Also, 74% of respondents in China have a process in place to validate and attest to other organizations’ use of third parties for ABC risk. However, only 24% of respondents in Hong Kong would perform in-person interviews, which is fairly low when compared globally (38%). A risk-based due diligence approach is recommended when managing third-party risks. Aside from screening, when faced with higher-risk subjects, enhanced due diligence can include processes such as in-person or telephone interviews, third-party training and third-party risk questionnaires.

Traditional industry sectors, such as financial services, mining, oil and gas may generally be susceptible to enforcement actions from the SEC through FCPA in the Asia Pacific region. However, in 2021, Grab Holdings, a Singapore-based technology company and leading mobile FinTech application in Southeast Asia that provides mobility, deliveries and digital financial services,2 self-reported a potential FCPA violation with DOJ.3 Details of the violation have yet to be disclosed, and the status of the overall investigation is still ongoing. This self-reported event indicates that not only traditional industry sectors face challenges to ABC risk, but new, innovative technology sectors as well.

ABC Regulatory Horizon

In Kroll’s analysis of survey data in 2022, 62% of respondents in the Asia Pacific region indicated concerns regarding the regulatory horizon for the next 12 months due to the stricter and increased global regulatory environment to where the Asia Pacific company operates.

In the U.S., President Biden launched an anti-corruption initiative in June 2021 that declared combatting corruption as a core national security priority.4 Similar developments have also occurred in China, where there was an increased anti-corruption enforcement effort in 2021. For instance, the Chinese Communist Party’s Central Commission for Discipline Inspection (CCDI) has provided anti-corruption communique in January 2021 and CCDI guidelines to consolidate a blacklist for companies and individuals who offer or pay bribes in China in September 2021. This reinforces the regulatory landscape continued to evolve since 2021, and as such, only time will tell what its impact will be on ABC risk faced by corporations.

ESG and ABC Programs

Many companies strive to operate responsibly. Environmental, social and governance (ESG) is often a criterion used to help companies assess their goals to ensure long-term sustainability. In Kroll’s analysis of survey data in 2022, 69% of respondents in the Asia Pacific region indicated the main challenges to implementing ESG by compliance function are the lack of standardization and limited ESG data in Asia Pacific. These results align to what Kroll experts are observing in the market, where efforts to resolve the mentioned challenges are being made.

The diversity of ESG information makes it challenging to have a standardized global reporting framework in place, according to research by the Hong Kong Institute of Certified Public Accountants (HKICPA).5

Current ESG reporting frameworks have different reporting purposes, and practitioners would need to understand the circumstances of different organizations to apply principles in multiple different ESG international reporting frameworks, such as the Global Reporting Initiative Standard (GRI) and United Nations Sustainable Development Goals.

Under the Hong Kong Exchanges and Clearing (HKEX) ESG Reporting Guide in March 2020,6 anti-corruption is reported on a “comply or explain” basis. Practitioners would have to report ESG requirements based on their company’s understanding through conducting its own materiality assessments. The materiality assessments will include internal and external factors, such as corporate strategies, laws and regulations, future challenges, etc.

Russia’s Military Action in Ukraine in 2022

Russia’s military action in Ukraine in 2022 drove significant changes to the global trade landscape, such as reduced agricultural supply in Ukraine 7 and energy supply in Russia,8 as well as impacts to Asia Pacific. As Russia’s military action continues, the assessment to its regulatory impact proves challenging, as there continue to be constant shifts to adapt to the complexity of the situation. As of March 2022, according to the Association of Certified Anti-Money Laundering Specialists (ACAMS) in response to Russia’s military action in war on Ukraine, the U.S., UK, EU, Canada, Australia and Japan have imposed asset freezing and certain transaction restrictions on individuals and banks.9 ,10,11The sanctioned individuals and banks include Russian billionaires, Russia’s largest bank and Russian individuals who held or continue to hold prominent positions in state-owned entities. Given the complexities of these rapidly changing restrictions, the list of individuals and banks continues to be modified and updated based on clarifications from respective locations. These collaborative actions may indicate an increased effort to closely monitor Russia’s international trades.

In March 2022, the concept of “secondary sanctions” surfaced in the public media. Secondary sanctions apply to individuals or entities that deal with sanctioned targets that do not involve U.S. dollars or goods. As such, a range of penalties can be imposed to individuals or entities under the U.S. regulations, including exclusion from the U.S. market.12 According to the March 28, 2022, White House briefing by Press Secretary Jen Psaki, “he [President Joe Biden] also conveyed and described the implications and consequences if China provides material support to Russia.”13 As of March 2022, there was no official confirmation to “secondary sanctions” on any individuals or entities in the mainland China region, and its assessments to potential impact of regulatory risk proves challenging, and its impact is to be observed.

Conclusion

The regulatory landscape is evolving, as 62% of Asia Pacific region respondents from our Kroll survey indicated concerns regarding the regulatory horizon for the next 12 months due to the stricter and increased global regulatory environment on Asia Pacific region. The regulatory changes include an anti-corruption initiative launched in June 2021 in the U.S. that declared combatting corruption as a core national security priority. And in China, CCDI has provided anti-corruption communique in January 2021 and CCDI guidelines to consolidate a blacklist for companies and individuals who offer or pay bribes in China. Additionally, there have been consistent signals to ABC enforcement efforts, with strong commitment to building a more comprehensive, robust and effective ABC regime in the respective region in operation. The ABC enforcement signals that nearly 70% of respondents from our Kroll survey in Hong Kong and mainland China have either experienced enforcement action or identified breaches for bribery and corruption, including U.S. SEC enforcement news on FCPA in 2021. Although many companies have a certain degree of third-party risk compliance programs in place, implementing enhanced due diligence would gain a better picture of the third-party risk network.

With new innovative business models (i.e., FinTech or technology companies) beginning to progressively cause radical shifts by challenging conventional industries, the respective operation regulations would also have to catch-up with these changes.

As seen with ESG reporting, which relies on the practitioners’ understanding of the company and the diversity of ESG information–as well as the need for corporate compliance programs to gain a better understanding of their third-party networks–an expanded scope to compliance responsibility is inevitable.

Sources:

1 https://www.justice.gov/criminal-fraud/page/file/937501/download

2 https://investors.grab.com/

3 https://www.sec.gov/Archives/edgar/data/0001855612/000119312521232151/d496451df4.htm

4 Page 16, Kroll ABC Report 2021

5 https://www.hkicpa.org.hk/-/media/HKICPA-Website/New-HKICPA/Standards-and-regulation/SSD/03_Our-views/TB_-Cir/Auditing/aatb5_20.pdf

6 https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Environmental-Social-and-Governance/Exchanges-guidance-materials-on-ESG/step_by_step.pdf

7 https://ihsmarkit.com/research-analysis/syngenta-warns-of-food-crisis-due-to-russiaukraine-conflict.html

8 https://www.bbc.com/news/58888451

9 https://www.acams.org/en/media/document/27281

10 https://www.acams.org/en/media/document/27501

11 https://www.acams.org/en/media/document/27491

12 https://complyadvantage.com/insights/primary-secondary-sanctions/

13 https://www.whitehouse.gov/briefing-room/press-briefings/2022/03/18/press-briefing-by-press-secretary-jen-psaki-march-18-2022/

Relevant Articles

Stay Ahead with Kroll

Background Screening and Due Diligence

Comprehensive spectrum of background checks, screening and due diligence services.

Third Party and Vendor Screening

Kroll’s Third Party & Vendor Screening solutions facilitate global anti-corruption compliance.

Supply Chain Risk Management Services

Helping clients build resiliency by proactively identifying, assessing, mitigating and monitoring their hidden supply chain risks.

Anti-Corruption

Kroll helps clients mitigate and respond to the risks associated with international anti-corruption legislation.

Anti-Money Laundering

Kroll’s anti-money laundering (AML) solutions are designed to help minimize the risks associated with money laundering and other illicit activities and to ensure compliance through the development and management of ongoing compliance programs and processes.