Brazil’s survey responses reflect the extent to which the country is grappling with a number of broad, systemic challenges. First, fighting bribery and corruption has dominated the national conversation in Brazil since the Lava Jato scandal broke in 2014. While the share of respondents in Brazil that report having experienced bribery and corruption only modestly exceeds the global average (29 percent vs. 23 percent overall), combating this threat is given greater importance in Brazil than in any other country in our survey: 77 percent of respondents in Brazil named it a priority. Bribery and corruption are often accompanied by money laundering, and indeed, money laundering incidents occur more frequently in Brazil than in any other country in the survey (23 percent vs. 16 percent globally).

In addition to confronting bribery and corruption, Brazil is in the process of developing an anti-cybercrime regulatory and enforcement infrastructure that matches the size and increasing maturity of its economy. Respondents in Brazil are more likely than participants from any other country in the survey to report leaks of internal information, which often occur via computer networks (55 percent vs. 39 percent globally); they also name data theft as their top risk priority (84 percent vs. 76 percent globally).

When evaluating the various mechanisms used to detect intrusions, respondents in Brazil express the least confidence in their compliance systems, with only 74 percent finding them effective. The efficacy of compliance measures depends greatly on the degree to which a company’s culture supports transparency and accountability. Respondents in Brazil give their organizations above-average marks for several of these components but indicate that other aspects have room for improvement—perhaps most importantly, the assurance that performance goals and incentives do not conflict with risk management practices (65 percent vs. 71 percent globally).

Respondents in Brazil report that they are affected by geopolitical risks. Fiftyeight percent of respondents say their organizations have felt the effect of newly imposed sanctions against business dealings with a government, entity or person; this percentage is higher in Brazil than it is anywhere else aside from India and China. Sixty-one percent of respondents in Brazil report that their organizations have been affected by government influence on a vendor, partner or customer (vs. 51 percent globally).

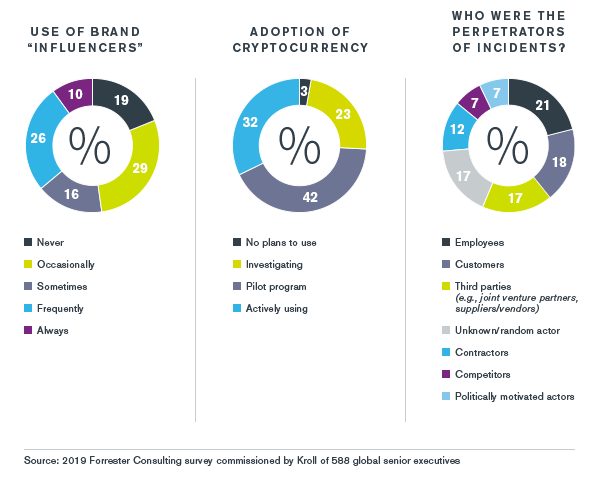

Like China, Brazil seems ambivalent about cryptocurrency. Ninety-seven percent of respondents in Brazil say their organizations are at least investigating cryptocurrency, if not actively using it. Paradoxically, though, when looking five years into the future, 74 percent of respondents in Brazil (vs. 53 percent globally) worry that cryptocurrency could lead to a destabilization of fiat currency.