Following a 2016 arbitration ruling that held companies responsible in certain circumstances for protecting their workers against social media attacks, Canadians are well aware of the risks of adversarial social media activity. Canadian respondents are more likely than those everywhere but in China to report that they have been a target of this type of threat (38 percent vs. 27 percent globally). Canadian respondents also report an above-average level of IP theft (33 percent vs. 24 percent globally), a finding that reinforces the argument for strengthening the country’s IP protections.

Canadian organizations are skeptical about the efficacy of many internal detection mechanisms. Only 58 percent of respondents consider their anti–money laundering controls effective in detecting incidents (vs. 69 percent globally); the same percentage call their whistleblowing function effective (vs. 66 percent globally); and 60 percent deem their anti-bribery and corruption controls effective (vs. 69 percent globally). Perhaps not surprisingly, a greater percentage of incidents were uncovered by external audit in Canada (26 percent) than anywhere else.

While Canadian respondents are likely to say that their organizations follow some cultural practices promoting transparency and accountability, the perception of a clear message from the top supporting integrity and accountability is significantly lower than the average (67 percent vs. 78 percent globally), as is the belief that their companies respond to risk management incidents in consistent ways (67 percent vs. 75 percent globally). These findings reflect an ongoing discussion within the country about strengthening regulations and developing a business culture that promotes consistent transparency, accountability and anti-corruption efforts.

In light of the various threats reported by Canadian respondents and the apparent below-average confidence in controls and key aspects of culture, it is surprising that a relatively low share of Canadian organizations in our survey consider mitigating risks to be a priority across all risk types. However, this apparently relaxed attitude toward risk does align with the relatively low percentage of Canadians who say there is clear messaging from the top of their organizations regarding the importance of integrity, compliance and accountability (as discussed above). This lower level of concern about risk extends to emerging threats as well. For example, only 49 percent of Canadian respondents are concerned about the possibility of a global financial crisis (vs. 69 percent globally), while just 44 percent express concern about the possibility of a breakdown of intergovernmental mechanisms for issues such as dispute resolution and free trade (vs. 61 percent globally). Canadian corporate leaders may wish to assess whether their organizations are assigning the appropriate level of importance to risk management.

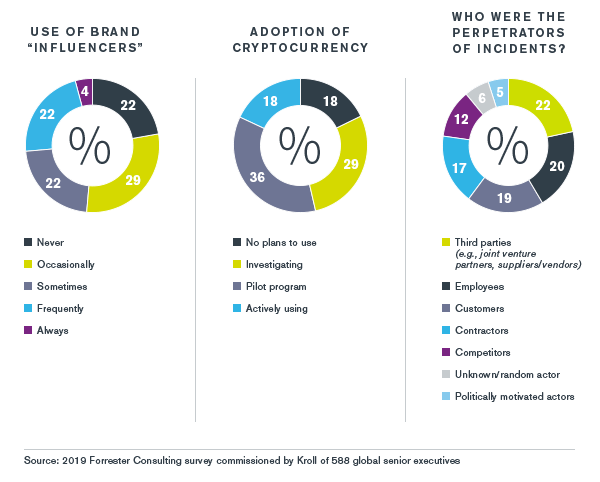

Cryptocurrency in Canada is facing increasingly aggressive regulation, having experienced major upheaval when the country’s largest crypto exchange went defunct following the CEO’s unexpected death in 2018. It makes sense, then, that Canadian organizations are cautious about adopting cryptocurrency. While above-average percentages of Canadian respondents report investigating adoption of cryptocurrency (29 percent vs. 22 percent globally) or having a pilot program (36 percent vs. 31 percent globally), only 18 percent of Canadian organizations actively use it (vs. 28 percent globally).