China’s emergence as a critical link in the global value chain has made organizations there prime targets for a variety of threats. A higher percentage of respondents in China than anywhere else have experienced IP theft in the past year (48 percent vs. 24 percent globally). An equal share have suffered leaks of internal information (vs. 39 percent globally), while 39 percent have been victims of data theft (vs. 29 percent globally). This threat profile has naturally informed the risk management priorities of China’s organizations. Combating IP theft is an almost universal priority in China, named as such by 94 percent of its respondents (vs. 72 percent globally); leaks of internal information (88 percent vs. 73 percent globally) also get significant attention, although Chinese respondents are less likely than average to prioritize mitigating the risk of data theft (70 percent vs. 76 percent globally).

Chinese organizations report a comparatively lower level of fraud by internal parties (18 percent vs. 27 percent globally) and by external parties (18 percent vs. 28 percent globally). However, based on the problems we are asked to solve for our clients in China, our observation is that fraud is a significant issue. This variance could be due to the fact that fraud often goes undetected for significant periods of time. Several survey findings support the assessment that Chinese organizations could take stronger anti-fraud measures. For example, respondents in China express less-than-average confidence in the detection capabilities of their compliance mechanisms (70 percent vs. 75 percent globally), and management in China plays a much smaller role in detecting incidents than does management in other countries (5 percent vs. 16 percent globally).

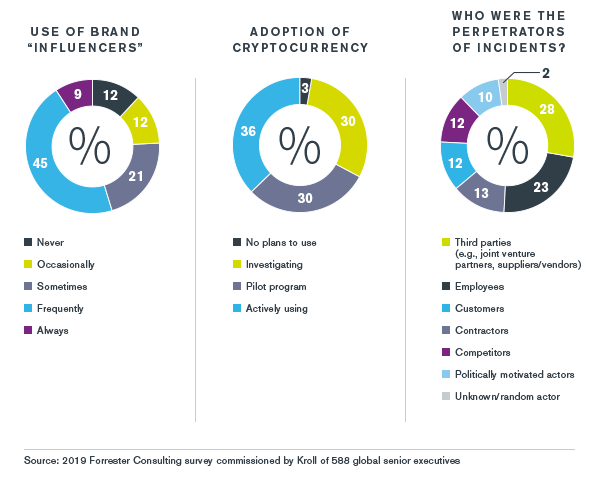

A larger percentage of incidents in China than anywhere else are attributed to third parties such as business partners and suppliers (28 percent vs. 19 percent globally). A desire to mitigate this risk may explain why nearly all respondents in China report conducting reputational due diligence on their business partners (96 percent vs. 92 percent globally).

Geopolitical issues loom large in the Chinese risk landscape. Organizations in China are more likely than those elsewhere to report having been significantly affected by many types of geopolitical risk, including tariffs, changes in economic treaties, political unrest and restrictions on foreign investment. Accordingly, Chinese companies prioritize mitigating the risk of disruption due to sanctions, tariffs and trade agreements more widely than do enterprises in any other country or region (85 percent vs. 62 percent globally).

A greater share of organizations in China than anywhere else say they use brand ambassadors or social media influencers frequently or always (54 percent vs. 32 percent globally). But the use of social media in China, as elsewhere, is a double-edged sword: A significantly higher percentage of companies in China than elsewhere report experiencing adversarial social media activity (39 percent vs. 27 percent globally).

China’s cryptocurrency environment is highly dynamic, with government regulators seeking to rein in high levels of digital asset activity. Despite the many unresolved issues, however, respondents in China are among the least likely to report that their organizations have ruled out using cryptocurrency (3 percent vs. 19 percent globally).