In 2016, the Mexican government integrated anti-bribery and anti-corruption frameworks among local, state and national jurisdictions, but it has not as yet aggressively prosecuted corruption allegations. Respondents’ organizations in the region have thus taken it upon themselves to increase the effectiveness of their own anti-bribery and anti-corruption controls, with 79 percent saying they are efficient or very efficient (vs. 69 percent globally). However, in the wake of high-profile cyberattacks on the national financial system and elsewhere, respondents in Mexico are less confident than most in their cybersecurity (68 percent vs. 81 percent globally) and have almost universally prioritized mitigating against data theft (89 percent vs. 76 percent globally). Mexican organizations are also still grappling with monitoring social media for adversarial attacks, with only half of respondents there calling those detection mechanisms efficient or very efficient (vs. 71 percent globally).

Respondents in Mexico give their organizations relatively low marks for reinforcing transparency and accountability. They are more likely than average to agree or strongly agree that they adapt their risk management processes to local market and cultural nuances (82 percent vs. 72 percent globally), but are much less likely to have the same opinion about other key components of company culture, from having the right message from the top of the organization (68 percent vs. 78 percent globally) to responding consistently to risk management incidents (57 percent vs. 75 percent globally). These results indicate a clear opportunity for Mexican enterprises to improve their risk mitigation measures.

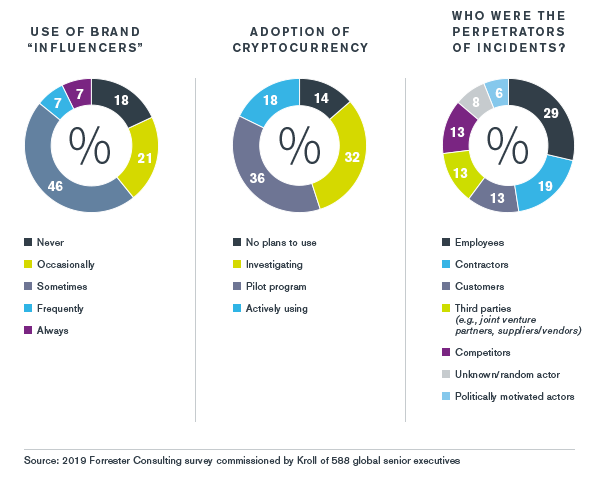

Mexico has recently enacted a new regulatory regime for financial technologies. As part of this initiative, the Bank of Mexico has imposed stricter restrictions on cryptocurrency exchanges. Not surprisingly, respondents in Mexico report a somewhat conservative approach to digital assets: Only 18 percent report that their organizations have actively embraced cryptocurrency platforms (vs. 28 percent globally) but an above-average percentage are in the investigation phase (32 percent vs. 22 percent globally).

Looking ahead, respondents in Mexico are less concerned than decision makers elsewhere about many of the future risks in our survey. For example, only 46 percent are concerned or very concerned about possible disruptions due to artificial intelligence (vs. 56 percent globally). However, the prospects for ongoing stability of intergovernmental mechanisms such as free trade agreements and dispute resolution elicit considerable apprehension in Mexico (71 percent vs. 61 percent globally). This unease contrasts sharply with the far lower share (14 percent vs. 27 percent globally) who report having been affected by disruptions due to tariffs, sanctions and free trade agreements in the 12 months before the survey was taken in April 2019. The disconnect between recent experience and worries about the future reflects respondents’ acute awareness of how quickly conditions have changed in the current geopolitical environment.