The risk landscape within the United States is somewhat more subdued than in most of the other countries and regions we surveyed, with most threats occurring at below-average levels. The few exceptions are the threat of disruption due to sanctions, tariffs and changes in trade agreements (30 percent vs. 27 percent globally) and some associated geopolitical risks, most notably new tariffs or trade wars (59 percent vs. 54 percent globally) and restrictions on foreign investment (51 percent vs. 47 percent globally). These findings reflect the country’s more aggressive trade policy in recent years. In contrast, bribery and corruption were reported by only 17 percent of respondents (vs. 23 percent globally), and leaks of internal information were reported at a lower rate in the United States than in any other country or region (29 percent vs. 39 percent globally).

The effects of geopolitical risks on U.S. organizations have not served to push mitigation strategies up the agenda there, however. Countering disruption from sanctions and similar actions is a priority for only 53 percent of U.S. respondents (vs. 62 percent globally). The prevalence of U.S. concerns about IP theft (70 percent vs. 72 percent globally) reflects ongoing issues with China. The position of data theft as the top U.S. risk priority could be a result of numerous high-profile data breaches that have increased awareness among regulators, investors and board members.

U.S. respondents give high marks to their compliance capabilities, with 84 percent calling this function’s detection capabilities effective. This confidence is mirrored in respondents’ strong belief that their organizational cultures support transparency and accountability. For example, 86 percent of U.S. respondents agree that their workplaces get a clear message from the top of their organizations that integrity, compliance and accountability are important (vs. 78 percent globally).

Organizations in the United States, like enterprises elsewhere, report practicing reputational due diligence widely—except that those in the United States are less likely than average to apply it to investors (76 percent vs. 84 percent globally). This anomaly may reflect the dominant role played in the United States by large investors, whose leadership teams are under close and ongoing scrutiny by both regulators and the business media.

Looking ahead, a sizable majority of respondents in the United States express concern about the possibility of a significant financial crisis (72 percent vs. 69 percent globally) as well as large-scale, coordinated cyberattacks (70 percent vs. 68 percent globally). Acknowledging the current geopolitical situation, they are also comparatively more likely to register concern about a breakdown of intergovernmental mechanisms (66 percent vs. 61 percent globally).

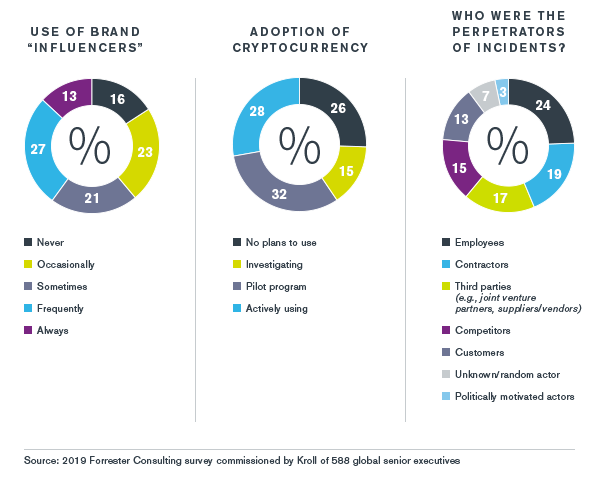

U.S. organizations have been relatively aggressive in their use of brand influencers, with only 16 percent of respondents saying they never use them (vs. 22 percent globally) and 13 percent saying they always use them (vs. 9 percent globally). U.S. enterprises’ adoption of cryptocurrency, meanwhile, is more restrained. While the share of U.S. organizations that report they are actively using cryptocurrency matches the global average (28 percent), the percentage saying they have no plans to do so (26 percent) is significantly larger than it is almost anywhere else (vs. 19 percent globally).