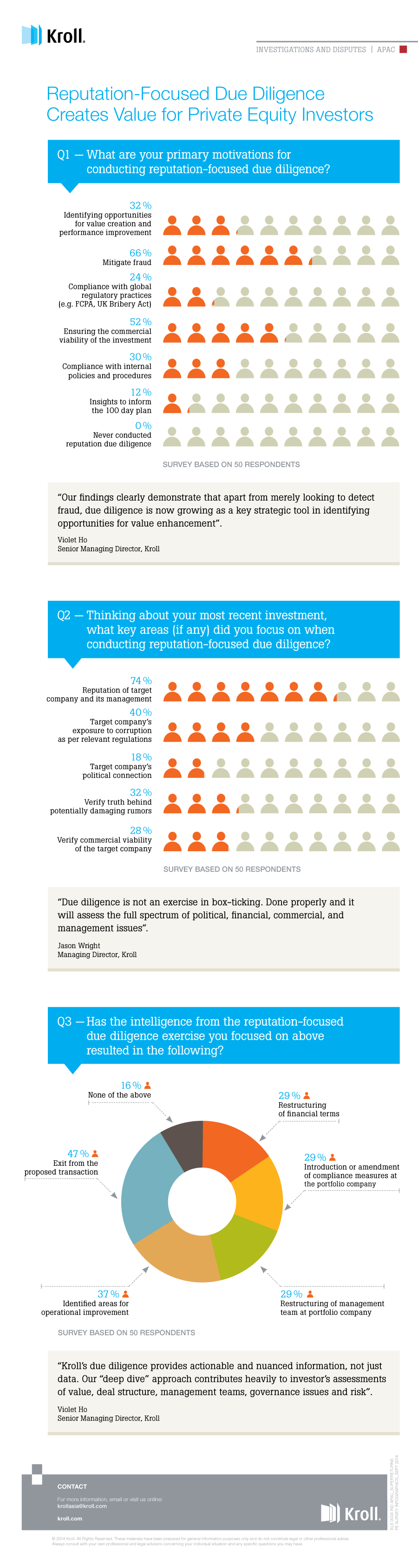

As private equity firms face increasing pressure to add operational value to their investee companies, based on a recent survey conducted by Kroll, it is becoming clear that far from merely looking for problems, private equity due diligence is now also being used as a critical strategic tool to identify operational improvement and value creation opportunities within potential portfolio companies.

The below infographic represents views of 50 private equity investors that were polled by Kroll in September 2014, and asked for their views on reputation-focused due diligence.

Kroll’s investigators leverage the most comprehensive set of databases, deepest analysis of public records, and access to a network of human sources to provide investors with an understanding of the proposed transaction(s) and the people involved. While the nature and extent of the reputational-due diligence varies depending on the facts and circumstances, it may often cover:

- investigating origins of wealth, behavior patterns, personal integrity and business acumen of key principals;

- identifying undisclosed liabilities, including management reputation, unresolved litigation or disputes, and known involvements in fraud or corruption;

- validating key commercial relationships and uncovering conflicts of interest or undisclosed related party transactions; and

The below infographic represents views of 50 private equity investors that were polled by Kroll in September 2014, and asked for their views on reputation-focused due diligence.

Reputation-Focused Due Diligence for Private Equity Investors – An infographic by the team at Kroll.

Embed Reputation-Focused Due Diligence for Private Equity Investors on Your Site

Copy and paste the code below

<img src=”http://www.kroll.com/getmedia/57f43094-2c54-462b-b762-f05842b0811f/reputation-focused-due-diligence-infographic.aspx” width=”540″><br /><br /><br /><br />

<p>Reputation-Focused Due Diligence for Private Equity Investors – An infographic by the team at <a href=”http://www.kroll.com”>Kroll</a></p><br /><br /><br /><br />

<p>

By Kroll Editorial team

Stay Ahead with Kroll

Background Screening, Market Intelligence & Investigative Due Diligence

When organizations worldwide need intelligence, insight and clarity to take decisive action, they rely on Kroll.