2024 Year in Review

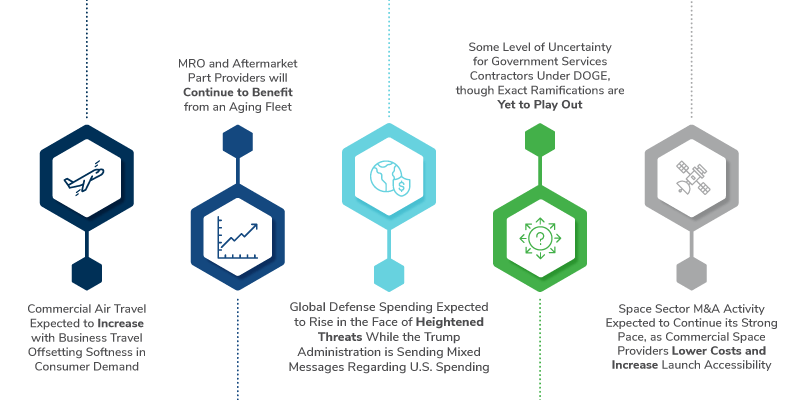

Most segments of the ADG industry are experiencing positive momentum. Strong demand for commercial air travel with continued year-over-year growth in revenue passenger miles is benefiting operators and driving demand for aftermarket parts and services. New aircraft delivery delays are further boosting aftermarket demand as operators are forced to use older aircraft which require more frequent shop visits. While new aircraft deliveries remain well below pre-COVID levels due to Boeing’s challenges, orders for commercial aircraft are keeping pace with deliveries leading to record or near record backlog for Airbus and Boeing.

Defense spending by the U.S. and many of its allies reached multi-decade highs due to ongoing hostilities in Ukraine and the Middle East, and continued heightened concerns over Chinese strategic actions, driving strong performance from prime contractors and subcontractors. Meanwhile, the US federal budget continued to expand with a focus on IT infrastructure and cybersecurity.

ADG M&A volume in 2024 increased 13% from 2023 marking the first year-over-year increase since 2021. Despite the increase, M&A activity remained below the 10-year average with 403 completed transactions in 2024. Declining interest rates, increasing availability of debt financing and growing confidence in the economy drove an increase in valuations and buyer appetite. While M&A activity was relatively moderate, the stock price performance of most ADG sectors kept pace with or surpassed the performance of the Dow and S&P 500.

2025 Outlook

Many of last year’s trends in commercial aerospace are expected to carry over into 2025. Demand for commercial air travel and hence demand for aftermarket parts and services is anticipated to remain strong; although, growth in air travel is slowing due to an end in post-COVID revenge spending and financial pressures on consumers. Commercial aircraft deliveries from Airbus and Boeing are forecast to increase 15% in 2025, which should be a boost for engine and airframe part manufacturers.

The new Trump administration’s impact on defense spending remains unclear as there will certainly be a shift in priorities under an “America First” agenda. Threats from near-peers China and Russia, as well as other global adversaries persist, and there remains an urgent need to invest in modernization and replace depleted weapon stockpiles. The new Department of Government Efficiency (DOGE) commission will scrutinize new contracts and spending, which is expected to create challenges for government service providers and defense contractors.

M&A activity is expected to continue to rise in 2025. Strategic buyers are optimistic about the economy and the outlook for their own businesses. Private equity firms are sitting on a record amount of uninvested capital and will benefit from lower interest rates and a favorable debt market. Private sellers are increasingly more receptive to exploring exit options while private equity firms are facing mounting pressure from limited partners to exit businesses and return capital.