COVID-19 has taken an immense toll on public health, both physically and mentally, and we hope you are staying safe and healthy during these uncertain times. Despite looming health concerns, supply shortages and social isolation extending into May for most, we can look to some positive news regarding returns on investment for the financial sponsor community.

The first quarter of 2020 witnessed significant volatility and uncertainty about future returns on capital as a result of COVID-19, and its impact on the market. Full-year outlooks change daily as key questions remain unanswered–when will COVID-19 reach its “peak”? How long will businesses be closed? Will these businesses have the liquidity to re-emerge intact once normalcy is resumed?

Institutional investors are at an impasse as they consider how to put funds to work and how to rethink hold periods of existing assets. To eliminate some of the guesswork, Duff & Phelps developed a set of leveraged buyout scenarios (LBOs) for a hypothetical company acquired at the end of 2019, to illustrate this point across various time horizons (five, six and seven years) and recovery scenarios (V-Shaped, U-Shaped, and L-Shaped).

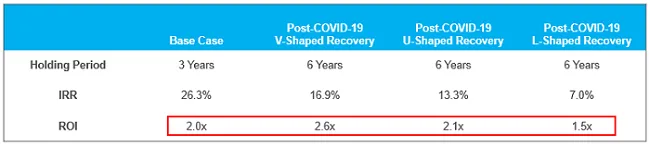

While potentially obvious to some, internal rates of return (IRRs) will decline due to longer durations and lower debt capacity, but cash-on-cash return on investment (ROI) can be preserved by extending holding periods until financial performance has stabilized and the asset is again marketable in year 2024 (V-Shaped), 2025 (U-Shaped) or 2027 (L-Shaped).

ROIs comparable to a “base case” LBO (without a downturn in 2020) and even IRRs outperforming expected market returns adjusted for risk and size are achievable in the most likely recovery scenarios, though a steeper and more drawn-out “L-Shaped” curve may erode those returns in the near term.