Tue, Nov 1, 2016

The Real Challenges of the Indian Banking Sector

Tarun Bhatia, Managing Director, Forensic Investigations and Intelligence in Kroll India, talks about the current scenario and discusses the various investigative tools available for banks to counter rising non-performing assets (NPAs).

Banks, especially state-owned ones, are currently witnessing static growth, rising asset quality concerns, and declining profitability. Compounding the problem, the sector is embroiled in multiple corruption, fraud, and bribery-led scandals which are currently under investigation. With slowing global growth and limited uptake in economic activity in India, banks are likely to face a very challenging 12-18 months. The Central Bank, The Reserve Bank of India (RBI), has initiated various steps to help banks manage these challenges, but these have not yet resulted in any meaningful benefit. Is the weak economic environment really the biggest challenge for the banking industry or do the banks have more structural internal problems?

Why Have the NPAs of Indian Banks Ballooned in the Recent Past?

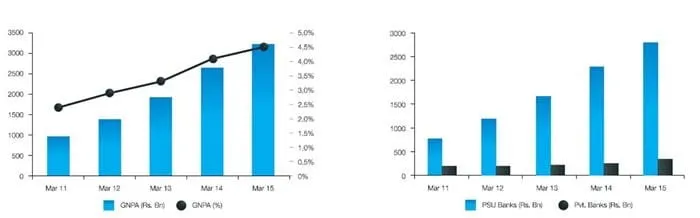

Indian banks have witnessed a rapid surge in NPAs over the last four years with gross NPAs rising sharply from 2.36% in March 2011 to 5.1% in September 20152. The sector’s stressed assets (GNPAs plus restructured standard advances) are projected to currently be at INR 7500 billon (USD 115 billion) – 11.3% of total banking sector assets3. During the last four years, the growth in NPAs has been much higher than the growth in advances. While the economic slowdown has affected the debt repaying capability of the corporate borrowers, Kroll’s analysis reveals that insufficient pre-sanction due diligence and inadequate portfolio monitoring have allowed borrowers to divert funds to unrelated activities and siphon money, resulting in defaults. A large proportion of these defaults are willful – which means the corporates and/or their promoters have the ability to repay but have chosen to default instead. According to a recent media report, there are as many as 7,035 willful defaulters who owe about INR 590 billion (US$9 billion) to state-owned banks4. This report suggests that willful defaulters constitute approximately 22 per cent of the gross NPAs of state-owned banks in India.

Once a Company Defaults, How Can a Banker Identify if There Is Fraud Involved on the Borrower's Side?

As part of a bank’s credit monitoring process, it is required to collect information about the performance of the company (borrower) on an ongoing basis. However, a borrower whose intention is to defraud the bank can submit false information on the financial position of the company. Kroll’s experience suggests that when the economic environment is fragile, promoters take the cover of weak demand and rising debts to delay making payments to banks. Our investigations have uncovered indicators, which if monitored closely, can help the bank’s relationship manager identify red flags that warrant a deeper assessment of the borrower or escalation to the bank’s senior management team:

- Change of external auditor immediately after fund-raising or frequent changes of auditors

- Frequent changes in the senior management team

- Significant movement in inventory or receivables

- Bills remaining overdue for a long period

- Frequent invocation of bank guarantees and devolvement of Letter of Credit (LCs)

- Active issuances of inter-corporate deposits and other inter-group transactions

Non-Performing Assets in Indian Banking Sector5

An early detection of these red flags can help the bank take corrective action and prevent a fraud and eventually, a default. While building a strong relationship with clients and maintaining trust is important, banks should not do this at the cost of negligence. Kroll’s latest edition of its Global Fraud Report6 also indicates that companies face an increased risk of fraud from within, hence it is important for a bank to ensure that there are adequate layers of checks in their systems which are aimed at preventing bank employees from colluding with borrowers.

If a Bank Suspects a Fraud by the Borrower, What Should It Do?

It is important for the concerned branch or zonal office to alert the senior team at the first suspicion of fraud. The risk management team and credit team should quickly gather all the information available on the account and highlight any inconsistencies. However in times like this, promoters often do not provide reliable financial information to banks about the true status of their operations. In such cases, banks can use a specialist firm to conduct a discreet, “outside- in” external investigation of the company. This can provide potentially useful indications of poor business practices or malfeasance on the part of the company; the promoter’s reputation in the market as well as their potential conflicts and assets; and whether the promoter or management of the company have been involved in fraudulent practices and if so, what these practices are. This information, if obtained early, can provide banks leverage for negotiations with errant promoters.

When a company has already defaulted but the bank suspects fraud, the options available to the bank are limited. The bank will have to follow the existing regulatory and legal process to recover its money. While this process can take many years, banks do have a way which can help them in at least partial recovery. In India it is a common practice for promoters to issue personal guarantees to banks as part of the security mechanism and loan documentation. If the company defaults, the promoter becomes personally liable to repay to the banks. In India, in most cases, promoters suggest that they are bankrupt and do not have the means to pay the bank. There have been instances where promoters continue to maintain their lifestyle while delaying payments to the bank. In such scenarios it becomes important for banks to identify unencumbered personal property of the promoter against which the banks can recover their dues. Asset searches are complex and require on-the-ground intelligence-gathering to identify different forms of assets like land, real estate, aircrafts, yachts, art collections, and luxury collections which are either directly owned by the promoters or held by close confidantes on their behalf. A bank’s ability to identify such unattached assets can enable it to have an upper hand when negotiating revised terms with the borrower.

Given the Rising NPAs and Restructured Assets on Account of Fraud and Misrepresentation, What Steps Can Banks Take to Counter the Problem?

The increased incidence of corporate frauds in India reflects potentially weak corporate governance standards of borrowers, inadequate credit risk management capabilities of banks, and the inability and/or reluctance of lenders to take legal recourse due to what is often perceived as a tedious and unwieldy judicial process. This puts additional responsibility on Indian banks to do thorough due diligence before approving or sanctioning loans. The first and the most important thing is for the banks to accept that there are gaps in the current process that warrant serious attention from the board and senior management team. The RBI, well aware of this gap, has advised banks that credit risk management should receive the top management’s attention and the process should encompass7:

- Measurement of risk through credit rating/scoring;

- Quantifying the risk through estimating expected loan losses and unexpected loan losses;

- Risk pricing on a scientific basis; and

- Controlling the risk through effective loan review mechanism and portfolio management.

While these steps may help in controlling the rise of NPAs, they are not sufficient to protect banks against willful defaults. Given the complex operating environment and the powers of Indian promoters, banks need to do more to protect themselves against misrepresentation by the borrowers. In Kroll’s experience, offenders tend to cover their tracks with false documentation that appear genuine and do not raise alarms at the pre-sanction stage. Banks can avoid or mitigate their risks of falling prey to such misrepresentation by conducting in-depth and independent due diligence on the borrower. Indian promoters closely manage their business, and it is important for banks to understand the operating principles of the promoters, their integrity, and overall governance standards of the company. This would involve being aware of the background of the promoters and the company, understanding the inter-group linkages, and investigating recent performance- related red flags that are identified during credit assessment. It is critical that banks select due diligence providers on a “no compromise basis” to ensure that such providers are truly independent and the integrity of the due diligence process is maintained. Kroll understands that it may be difficult and expensive for the banks to do this on every account and hence recommends a minimum loan size (depending on the size of the bank) for the implementation of the same. The RBI, under the recently released framework for dealing with bank frauds, has suggested an exposure of INR 500 million8 or more as the threshold for classifying an account as a “Red Flagged Account”. The same can be used as a reference while reviewing new accounts. A thorough assessment at the pre-sanction stage is a job half done. It is equally important to closely monitor the performance of the company post-disbursement. Most banks tend to rely on the data shared by the borrower and do not ask too many questions as long as the loan is being serviced on time. We believe this is not enough, and it is important for the credit officer to keep an eye on the red flags.

Banks should take an active and investigative approach to understanding the ongoing business practices and controls in the company and use various fraud prevention tools to protect their interests. Kroll has worked closely with banks globally in reviewing their fraud identification and fraud management processes and helped them identify fraud at an early stage, so as to be able to prevent a loan from turning into a NPA.

Eleven New Small Private Banks Will Be Entering the Sector Shortly—any Lessons for Them?

India is an under-banked country, and the issuance of new banking licenses is expected to increase the level of financial inclusion in the country, which is a welcome step. At the same time, India already has a large number of banks and entry of new banks will make the sector more competitive. It is important for the new banks to accept that banking is a long-term business and there are no short-cuts to success. Kroll believes that the new small private banks and the payment banks will change the face of Indian banking by 2020. They have a huge opportunity in front of them and, to a large extent, control their own destiny. In our experience, some of the guiding principles which will help them a long way would include:

- Being selective and diligent about their hiring process

- Implementing strong enterprise-wide risk management practice from inception

- Setting up a comprehensive credit assessment and credit monitoring cell which looks beyond financial information

- Building robust IT security practices to protect themselves from data theft and cyber crimes

- Applying employee-friendly whistleblowing policies which encourage the reporting of frauds

Sources:

1 The Reserve Bank of India

2 http://www.financialexpress.com/article/industry/banking-finance/npas- could-reach-5-4-by-september-2016-says-rbi/183261/

3 RBI Financial Stability rel="noopener noreferrer" Report December 2015 - https://rbidocs.rbi.org.in/ rdocs/PublicationReport/Pdfs/0FSR6F7E7BC6C14F42E99568A80D9FF7BBA6.PDF

4 Economic rel="noopener noreferrer" Times, 18th October 2015 http://economictimes.indiatimes.com/industry/ banking/finance/banking/7035-wilful-defaulters-owe-rs-59000-crore-to-psu- banks/articleshow/49438094.cms

5 The Reserve Bank of India - http://dbie.rbi.org.in/DBIE/dbie. rel="noopener noreferrer" rbi?site=publications#!4

6 http://www.kroll.com/global-fraud-report

7 Keynote address delivered by Shri R. Gandhi, Deputy Governor, Reserve Bank of India rel="noopener noreferrer" at the The Economic Times ReModel in India – rel="noopener noreferrer" Asset Reconstruction & NPA Management Summit, Mumbai on Sep 15, 2015. https://rbi.org.in/scripts/ BS_ViewBulletin.aspx?Id=15837

8 https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9713&Mode=0

Intelligence, Transactions and Due Diligence

When organizations worldwide need intelligence, insight and clarity to take decisive action, they rely on Kroll.

Forensic Investigations and Intelligence

The Kroll Investigations, Diligence and Compliance team consists of experts in forensic investigations and intelligence, delivering actionable data and insights that help clients worldwide make critical decisions and mitigate risk.