The COVID-19 pandemic and resulting disruptions to business operations and financial markets have presented unique challenges and opportunities for those managing multinationals’ transfer pricing. Broad changes to transfer pricing flows and results year-over-year have required tax departments to change their transfer pricing policies on the fly and/or manage audit risk. To better understand how multinationals are managing in the current environment, Kroll Transfer Pricing practice recently conducted a survey of tax directors at multinational corporations to understand how their tax and transfer pricing positions have been (or are expected to be) impacted.

The Respondents

Kroll survey garnered responses from representatives of companies spanning a wide range of industries, sizes (roughly one-third each under $1 billion, between $1 and $10 billion, and above $10 billion in annual revenues) and locations (roughly half of respondents reported being based in the U.S., with the remainder spread across the globe).

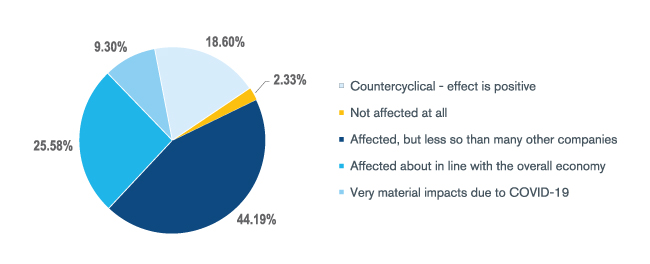

Respondents also differed in the extent to which they had been affected by the pandemic. 79% of respondents reported that COVID-19 had disrupted their company’s operations and financial results, but that sample was split nearly in half between those that considered their company to have been less affected than many other companies (44% of all respondents) and those that saw their company either affected in line with the overall population (26% of all respondents) or were facing very material impacts (9% of all respondents). 19% of respondents reported the pandemic actually having a positive impact on their business results, and just one respondent (2%) that saw no impact at all.

How Much Has COVID-19 Disrupted Your Company's Operations and Financial Results

The majority of respondents do believe that operations will normalize, with 51% anticipating recovery in line with the overall economy; only 19% consider any operational changes to be somewhat permanent.

Cash Management Considered a Priority

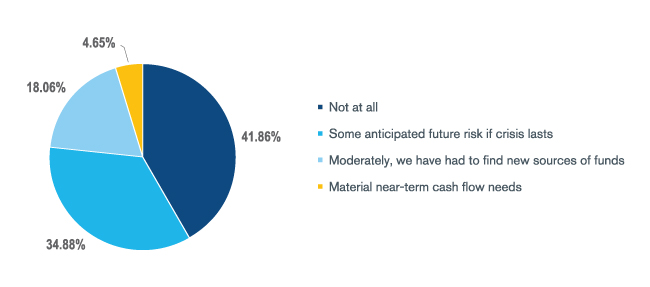

When asked what respondents considered to be their tax team’s priorities in the current economic environment (noting that respondents were able to select multiple options as priorities), cash management was the most popular answer, with 72% of respondents selecting it as a priority. This is perhaps not a surprising result given that 58% of respondents noted COVID-19 disruptions have created at least some anticipated future risk of an inability to meet cash flow needs (e.g., paying suppliers or lenders), though most of that 58% only anticipate future risk if the crisis lasts. That said, only about one-third of respondents are presently considering any changes to intercompany financing policies as a result of COVID-19.

To What Extent Have COVID-19 Disruptions Actually Threatened Your Ability to Meet Cash Flow Needs in the Short Term (E.g., Paying Suppliers or Lenders)?

Concerns About Audit Risk – for a Variety of Reasons

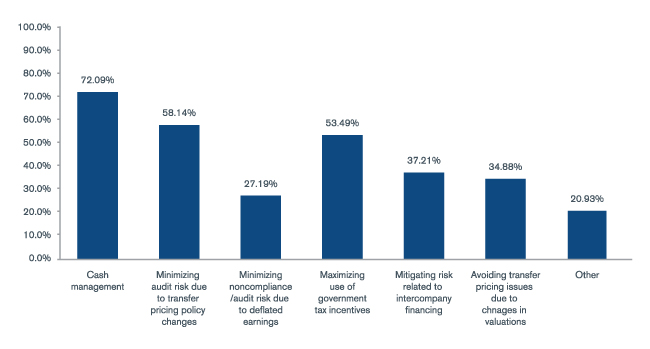

The second most popular response to the question on tax team priorities was minimizing audit risk stemming from changes in transfer pricing policies, selected by 58% of respondents. In addition, 28% of respondents selected said they are prioritizing minimizing noncompliance/audit risk due to deflated earnings. Several additional respondents selected “other” to the question on transfer pricing priorities but wrote in responses related to audit risk (stemming from a different cause than changes in transfer pricing policies), either anticipating more aggressive tax authorities, audit risk surrounding their decision to not make changes as a result of the pandemic or anticipating greater audit risk because their taxable income had actually increased due to the pandemic. As such, minimizing audit risk is clearly top of mind for many tax departments, though the exact reason for audit concern may differ. Per a later question in the survey, 56% percent of respondents in total are expecting additional audit risk either due to changes in transfer pricing policies or changes in returns earned by different legal entities.

The other commonly selected responses to the question on tax team priorities were maximizing the use of government tax incentives (53%), mitigating risk related to intercompany financing (37%) and avoiding transfer pricing issues due to changes in valuations (35%).

What Do You View as Your Tax Team's Priorities in the Current Economic Environment? (Select All That Apply)

Multinationals Making Changes to Transfer Pricing Policies

Kroll asked respondents survey questions regarding anticipated changes to transfer pricing policies or approaches. 40% of respondents had already made changes to their transfer pricing policies (including either broad structural changes or changes to markups and prices within the existing structure) as of the survey date. Additionally, 58% of respondents expect there to be additional audit risk around transfer pricing as a result of either changes to transfer pricing policies or changes in returns earned by different legal entities.

With regards to what specific changes they might be considering to their transfer pricing in response to the pandemic, we highlight the following:

- Roughly one-third of respondents are anticipating making changes to their transfer pricing treatment of limited risk entities to account for losses or lower-than-usual returns, with 21% planning on changing markups and 9% planning on making broader structural changes.

- Roughly one-third of respondents are considering changes to their intercompany financing policies.

- Just 16% of respondents have seen changes to intellectual property or other valuations (e.g., goodwill impairment) that have materially impacted transfer pricing results.

- 46.5% of respondents anticipated needing to make changes to their transfer pricing documentation to account for the impact to the pandemic.

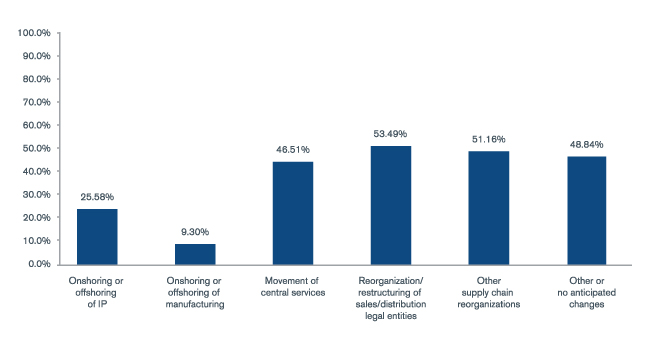

Finally, when asked to select any strategic transfer pricing policies that their teams were considering, “movement of central services,” “reorganization/restructuring of sales/distribution legal entities,” and “other supply chain reorganizations, such as changing the source of goods internally or externally” were each selected by around 50% of respondents. “Onshoring or offshoring of IP” (26%) and “onshoring or offshoring of manufacturing” (9%) were also selected.

Is Your Team Pursuing Strategic Transfer Pricing Opportunities?

More information on how Kroll can assist with audit readiness in the current environment can be found here.

Connect With Us

Stay Ahead with Kroll

Valuation Services

When companies require an objective and independent assessment of value, they look to Kroll.

Transfer Pricing

Kroll's team of internationally recognized transfer pricing advisors provide the technical expertise and industry experience necessary to ensure understandable, implementable and supportable results.