When Duff & Phelps’ Real Estate Advisory Group (REAG) conducted its survey of commercial real estate last year, the pandemic in many countries appeared to be easing. Instead, for most, it proved a lull before devastating additional waves.

Now, there are once again signs of optimism in global real estate and economies more broadly, but huge uncertainty remains. For many, a new normal is still just taking shape, and – as environmental protests and the UN Climate Change Conference, COP26, remind us – it is not the only long-term change with which the industry contends.

Will such optimism prove misplaced again?

To find out and explore the impact of all this on valuations, REAG returned to its network and the GRI Club in November 2021to ask about the industry’s expectations, hopes, and fears.

Together, we’ve surveyed 179 commercial real estate professionals from around the globe. Close to half of these (46%) were from the UK, hard hit by the pandemic but potentially now emerging from its worst effects. But we also had respondents from elsewhere in Europe (27%), the US (17%) and further afield.

We have included private property companies, funds and investments managers, as well as a range of publicly listed property companies and REITs, real estate operators, lenders and real estate service firms. They bring a wide range of perspectives.

We hope the results will provide some light for an industry still faced with charting an uncertain future.

Not Doom, but Gloom

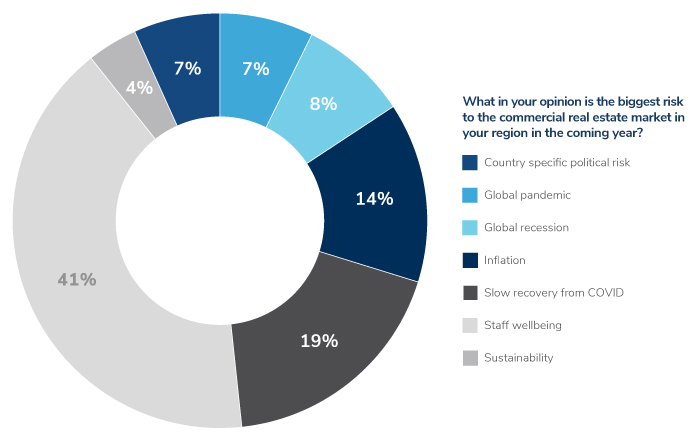

In some respects, the survey clearly shows increased confidence in global real estate. Despite high levels of infection in countries such as the UK during the survey period and rising cases elsewhere, concern over Covid has eased. Fewer than one in ten (8%) still feel the pandemic is the biggest risk facing real estate in their region, down from a quarter last year.

More significantly perhaps, fears of a global recession – the key concern in the survey in the autumn of 2020 has diminished. Just 14% still see it as the biggest risk, down from almost two thirds (64%) worried about the prospect in 2020.

That’s the good news.

The bad is that the impact of Covid is far from over. Responses largely suggest that pessimism last year – when almost 80% predicted a U-shaped economic recovery, rather than the V of a sharp bounce-back – was well-founded. The slow recovery from Covid is now the single most significant risk to commercial real estate markets, with 41% in this year’s survey citing it.

Many still think the pandemic will weigh on valuations too. While half expect little or no impact from the virus in the coming year, and 8% believe it could even boost them, a substantial number disagree. More than one in five (22%) expect a negative impact of up to 5%, with a similar number expecting a 6-10% hit (13%) or even more (6%).

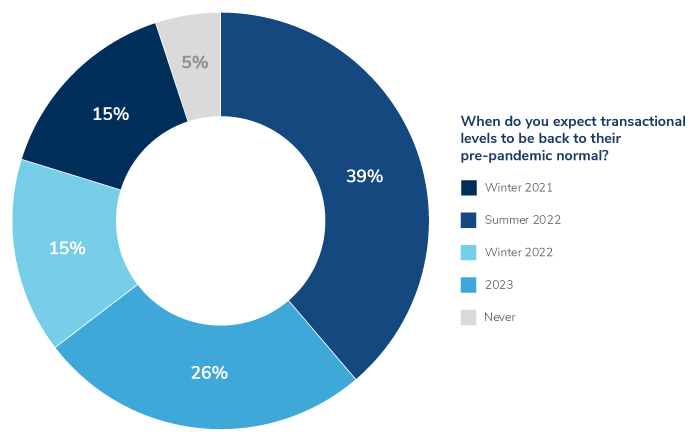

Most also believe transaction levels will take until next summer (39%) or winter (16%) to return to pre-pandemic levels. Over a quarter (26%) think it will only be in 2023 that they do.

Finally, with data now available, general worries over the economic impacts of the pandemic have crystalised into some concrete concerns. Not least of these is inflation – which hit 6.2% in the US in October and 4.2% (a ten-year high) in the UK. After the general disquiet over the speed economies will rally, these rising prices are now seen as the key risk to the commercial real estate market.

Looking on the Bright Side

Despite ongoing concerns, though, those surveyed say things are looking up – at least compared with last year. More than three quarters say they are either slightly (45%) or much more optimistic (31%) about the future of the real estate sector compared with the onset of the pandemic in March 2020.

While many still expect an impact from the pandemic on valuations, it’s far fewer than last year, and the fall feared is also far lower. Then, nearly four out of 10 respondents (39%) expected valuations to drop 5-10%, and almost a third (31%) feared an even heavier impact.

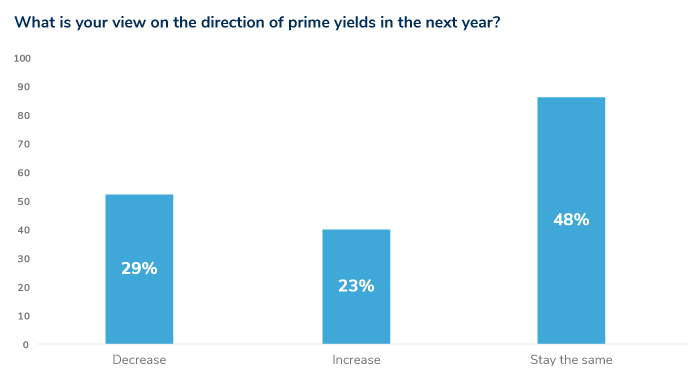

Respondents now are also split on the direction of prime yields in the coming year: 23% say they’ll increase, 29% decrease and 48% stay the same – although this did vary substantially between countries: Fewer than one in ten (9%) in the UK expect a rise.

Moreover, while transaction levels are down, it’s not solely due to the pandemic. Uncertainty around Covid was the major barrier identified by most (59%), with associated travel restrictions (11%) and slow vaccine rollouts (2%) also contributing. For a substantial minority, however, low stock levels are mainly to blame (21%). Again, this was a particular issue for those in the UK (27%).

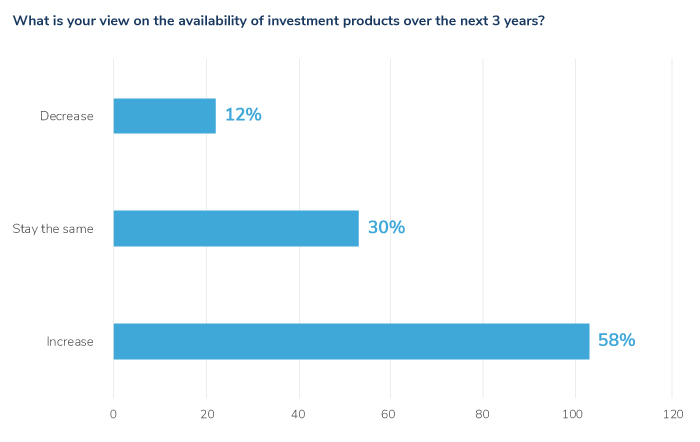

A majority (58%) also think the availability of investment products over the next three years will increase, while only 12% expect a fall.

Differing Fortunes

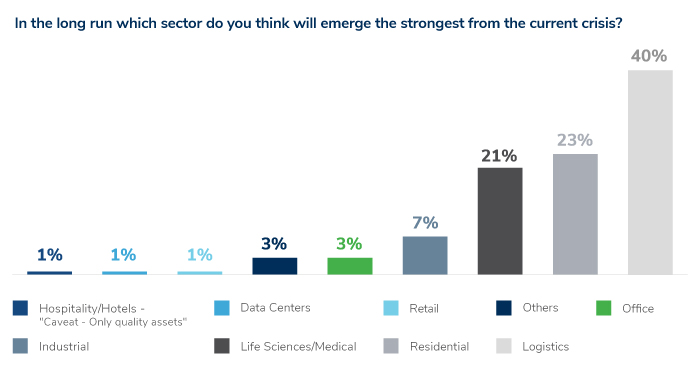

Crucially, of course, different sectors will experience differing fortunes. As last year, there’s significant confidence in the future for logistics real estate: 40% say the segment is likely to emerge strongest from the current crisis.

That’s perhaps not a surprise given predictions of global eCommerce sales hitting $4.2 trillion this year. In the UK, which accounted for the lion’s share of our survey respondents, Internet sales accounted for over a quarter (26.3%) of all retail sales in October 2021. That was up from 19.1% in February 2020.

Equally unsurprising, there’s significant optimism about the life sciences and medical real estate sector, which over a fifth (21%) expect to emerge strongest from the period. Three-quarters of those surveyed say the pandemic has boosted demand from investors, and while almost a quarter (23%) say pricing is artificially inflated, more than two-thirds say it is still fair value (65%) or even under-priced (12%).

Interestingly, residential property is also expected to exit the pandemic strongly (24%). Much of that might reflect longer-term drivers such as the supply shortages in markets including the UK’s. It may also be driven by activity linked to changing working patterns and the increase in working from home as well as the increased appreciation of living and garden spaces that lockdowns brought.

Although Covid has helped promote some sectors, it’s left the future of others highly uncertain. Ultimately, hotels and hospitality may recover, but few doubt damage has been done: Just 1% say they’ll exit the crisis strongest, and it’s the same for retail (also 1%).

The figures are barely better for office space (3%). While the extent of hybrid and homeworking in the long term remains unclear, few are predicting a very rapid recovery for the sector. Six in ten (61%) of those surveyed currently expect occupancy to fall by up to 10% over the next year as a result of the rise in remote and home working, and a quarter (25%) expect it to fall by more than this.

Only 14% say they expect occupancy to return to pre-Covid levels in 2022.

The ‘work from home’ phenomenon has been widely discussed elsewhere. We did not expect to see offices come out best. As always, location and specification will be all important.

Building Back Better

Finally, while Covid has dominated much of the discussion and drivers, it is not the only pressure bearing on global real estate.

COP26 in Glasgow, environmental protests worldwide and the net-zero targets and emissions targets adopted by many governments – and institutional investors – mean few industries will escape. The Insulate Britain protests blocking roads in the UK in recent months are a striking reminder that real estate is not one.

Far from distracting from this movement, the pandemic has enhanced it. Almost three quarters (73%) say that the pandemic has made sustainability more important to investors. Only 4% say it is less important than before the pandemic.

Asked how important sustainability is to the demand for real estate, a majority (51%) now say it’s crucial. Another 43% say it’s important, even if not a deal-breaker and only 6% say it has little effect on decision making.

Whatever else remains uncertain about what the new normal in real estate will look like, it seems increasingly likely that it will only come in green.