Duration: 1 hour

Discussion points included:

- Characteristics of recent corporate scandals involving both financial and non-financial matters that had an impact on the reputation, value and existence of organizations

- The red flags that could have assisted in the early identification of potential issues

- How organizations can better protect themselves from those risks

Notable Summaries From the Kroll Team

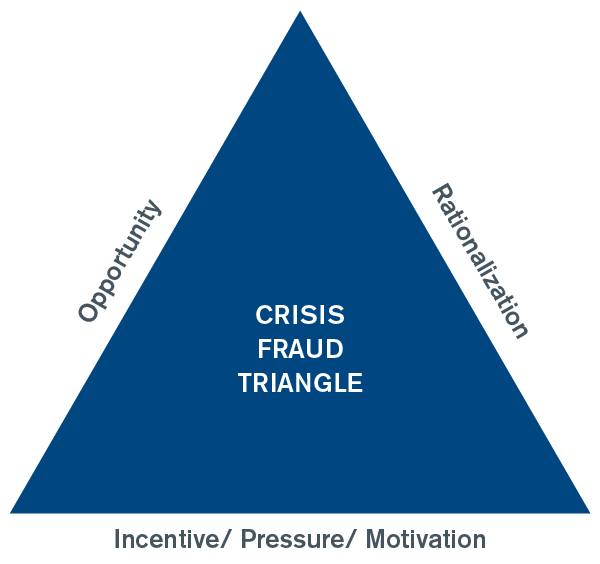

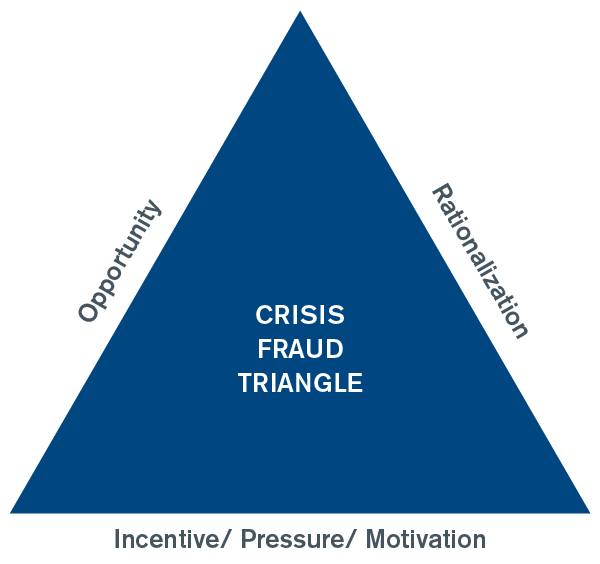

The Crisis Fraud Triangle and its Link to Corporate Scandals

“The fraud triangle is still a relevant model in understanding the risks to an organization as well as how to mitigate those risks.

“Incentive is heavily driven by the performance metrics of senior management that are often linked to remuneration. Traditionally, you see things like sales targets leading to inappropriate behavior usually driven by the requirements to show growth or generate revenue at the upper levels within an organization. This can be a red flag if it has the ‘too good to be true’ factor. You want to identify and mitigate any potential issues as soon as possible. However, if the growth is due to genuine success, surely you would want to replicate that across the business. [It’s important for businesses to know themselves]. The pressure is the fear of being fired or sales being so closely linked to remuneration that people are pressured into trying to either comply or meet certain targets or have to find alternative employment. This is a cultural issue that we see within organizations.

“Rationalization is also a cultural issue. It becomes part of this ‘everyone else is doing it’ or ‘it's for the good of the company’. Once misconduct has occurred, the rationalization becomes easier and the pressure grows to maintain that position. If people are caught I think the punishment aspect of this is key; we often see issues being swept under the carpet, which actually increases the opportunity for rationalization and the drive for certain cultural behaviors.

“Opportunity tends to be where most organizations focus more on the control environments—there tends to be the power dynamic within an organization and the control that certain individuals hold over the rest of the business. Recent major scandals have often had a central person or cabal of individuals who collude and work together in order to drive certain outputs within the organization.

The common denominator for all facets of the fraud triangle is culture and whilst this is predominantly a non-financial matter, if it's not understood and considered in its fullest then it can quickly become a financial issue.” – Peter Tutton

Lessons to be Learned

“One of the most obvious lessons is the reputational consequences of the shortcomings of an organization on the watch of a board director. At one end of the spectrum, they can be career limiting and at the other there are issues that invite a great deal of scrutiny from both regulatory and law enforcement bodies. A consequence of this is that an already fairly cautious buy-side investor gets nervous and possibly sells the equity or the debt at the first sniff of a problem. On a wider basis the access to money and the pool of investors that might consider investing in a company or acquiring a stock can reduce.

“Unfortunately, there's quite a lot that can be learned by looking around, reading the media, closely observing what's happening to others who are unfortunate enough to encounter problems on their journey. It’s possible that many corporate scandals have some form of cultural shortcoming. If we look at the UK we can see significant issues in some cases arising from cultural shortcomings, often they relate to dominant influences in the boardroom, and even sometimes outside the boardroom, where big personalities are overly aggressive and pressure staff or have one dimensional incentivization schemes. Dealing with these issues can be difficult as there's no doubt, it’s not straightforward and I think it requires quite strong non-executive directors.” – Neil Kirton

The Evolving Landscape – Supply Chains

“Another area where I think we've seen issues recently is supply chains, we've seen them pretty close to home in the UK whereas we’re a bit more used to seeing them in some of the emerging markets. Areas such as excessive working hours, poor pay and other forms of human rights abuse, apart from being unacceptable from a corporate conduct standpoint, create significant reputational and financial damage. Big customers are very unforgiving of these corporate shortcomings and they will drop suppliers as quickly as sponsors drop sports stars. I think organizations will put more money into supply chain issues in 2021 whether that's in response to COVID-19 and the issues around that, or whether it's a much deeper look at their suppliers from an ethical standpoint. We're already seeing more corporates reaching for know-how and tools that can help them.” – Neil Kirton

The Risk Register

“It's a core document, it evolves and changes, but it is the foundation for everything that happens in an effort to identify risks, how the risks are changing and to reduce the risk of [future] mishaps. Having an engaged board of directors and the right blend of temperament and skill sets is not an easy thing to achieve. One of the outputs that I expect to see as we move forward, hopefully in a measured and appropriate sense, I expect to see the number of independent reviews commissioned by boards go up.” – Neil Kirton.

Speakers

- Neil Kirton, Regional Managing Director, EMEA, Kroll

- Peter Tutton, Associate Managing Director, Kroll

- Daren Allen, Partner, Dentons

- Marija Brackovic, Senior Associate, Dentons