Mon, May 7, 2018

Duff & Phelps Launches the Cost of Capital Navigator

Read Valuation Insights, Second Quarter 2018

What is the Cost of Capital Navigator?

The Cost of Capital Navigator is an interactive, web-based platform that guides finance professionals through the steps of computing cost of capital, a key component of any valuation analysis, in accordance with best practices and the latest theory.

The Cost of Capital Navigator replaces the Duff & Phelps Valuation Handbook – U.S. Guide to Cost of Capital, which includes risk-free rates, equity risk premia, size premia, risk premia over the risk-free rate, and industry risk premia from two essential valuation data sets: the CRSP Deciles Size Study and the Risk Premium Report Study. Analysts have relied on that data for years to estimate cost of equity capital using both the capital asset pricing model, or CAPM, and various build-up models.

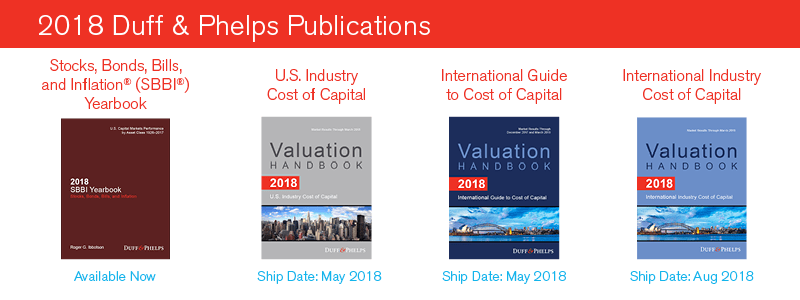

The other three Valuation Handbooks (Valuation Handbook – U.S. Industry Cost of Capital, Valuation Handbook – International Guide to Cost of Capital, Valuation Handbook – International Industry Cost of Capital) will be migrated to the new online platform beginning later in 2018.

Why did Duff & Phelps develop the Cost of Capital Navigator?

Estimating cost of capital requires matching risk of the subject business with the appropriate return. In the case of the Valuation Handbook – U.S. Guide to Cost of Capital, we have found that many users often struggle to fully take advantage of the wealth of data contained in it. Matching risk and return takes time. For example, understanding the application of size premia is more than simply picking a number from a table. Appropriate size premia selection requires an understanding of risk characteristics. The Cost of Capital Navigator is designed to assist the analyst with examining the characteristics of the subject company and then selecting the cost of capital data that best matches the risk profile. It is as if one of the Valuation Handbook co-authors were sitting alongside the analyst guiding them through the estimation process. The Cost of Capital Navigator helps users reduce errors and time spent on their analysis, and provides comprehensive documentation.

The Cost of Capital Navigator also improves user access to data as fast as the data is available. Analysts want access to the most up-to-date data at any time and from an array of devices. The shift from traditional books to a digital platform ensures that users are accessing the data they care about as quickly as Duff & Phelps can make it available. We are now able to make our data available to analysts much faster than was previously possible through print delivery.

What valuation data does the Cost of Capital Navigator include?

The Cost of Capital Navigator includes the (i) size premia, (ii) industry risk premia, (iii) equity risk premia (ERPs), (iv) risk-free rates, and (v) other risk premia from two essential valuation data sets that can be used to estimate cost of equity capital using the capital asset pricing model (CAPM) and various build-up methods, using two separate studies:

- The CRSP Deciles Size Study1, and

- The Risk Premium Report Study2.

Currently, both of these studies are updated with data through December 31, 2017. As of 2018, all data-years from 1999 through 2018 (data year 2018 includes the December 2017 data plus upcoming quarterly updates through 2018) are available in the Cost of Capital Navigator.

The valuation data and information in the Cost of Capital Navigator is the actual “as published” valuation data from the source publications.3

What are the subscription options that are available?

Duff & Phelps offers three subscription options: Basic, Pro and Enterprise. The Basic subscription provides data for the two most recent data years (i.e., 2017 and 2018) while the Pro subscription provides all data years, the 2018 data year plus historical data for all data years going back to 1999. The Enterprise license is the Pro subscription for companies that have more than 25 users.

Are the content, examples, FAQs, and methodology that were available in the hardcover Valuation Handbook – U.S. Guide to Cost of Capital available in the new online Cost of Capital Navigator?

Yes, the content, examples, frequently asked questions (FAQs), and methodology, from each of the Valuation Handbooks – U.S. Guide to Cost of Capital from 2014 forward, including the new content for the 2018 data year are available in the Cost of Capital Navigator, organized by chapter, fully searchable, downloadable, and printable.

Does the Cost of Capital Navigator provide comprehensive documentation?

Yes. The Cost of Capital Navigator is designed to guide the analyst through the data selection process in an efficient manner, providing auditable documentation at each step of the selection process for internal review and workpaper retention. All of this information is exportable to a PDF document or Excel spreadsheet.

Are users’ inputs and results confidential in the Cost of Capital Navigator?

Yes. Data confidentiality and security are strictly enforced within the system. Accounts are accessible only to the account owner. Only the account owner can view or modify an estimate.

What additional features are being planned for the Cost of Capital Navigator?

We will be adding sample report text for the analyst to customize that explains the sources of the data and the analysis process.

We will also be introducing a new workpaper package, which will provide sources of information, as well as brief explanations for all the inputs, assumptions, and methodologies employed when calculating a discount rate using the Cost of Capital Navigator. This package can be used by valuation professionals and companies to assist in their response to requests submitted by audit review teams related to how discount rates were estimated based on the Cost of Capital Navigator.

We will also be adding a module that will allow the analyst to use the data now published in the Valuation Handbook – U.S. Industry Cost of Capital to benchmark, augment, support, and strengthen the analyst’s own custom analysis of the industry in which a subject business, business ownership interest, security, or intangible asset resides.

Finally, we will be adding an Excel plug-in that will allow subscribers at the Pro and Enterprise levels to import any of the data available in the Cost of Capital Navigator directly into a new spreadsheet, or into their existing models.

How can I learn more about and purchase the Cost of Capital Navigator?

Visit dpcostofcapital.com

Sources:

1 Published in the Duff & Phelps Valuation Handbook – U.S. Guide to Cost of Capital from 2014 to 2017, and, before that, in the Ibbotson Associates/Morningstar Stocks, Bonds, Bills, and Inflation® (SBBI®) Valuation Yearbook from 1999 to 2013.

2 Published in the Duff & Phelps Valuation Handbook – U.S. Guide to Cost of Capital from 2014–2017, and before that, as the stand-alone Duff & Phelps Risk Premium Report.

3 Published in the Valuation Handbook – U.S. Guide to Cost of Capital from 2014 to 2017, and the Ibbotson Associates/Morningstar SBBI® Valuation Yearbook and Duff & Phelps Risk Premium Report from 1999 to 2013. The 1999–2013 Ibbotson Associates/Morningstar size premia, industry risk premia, and other valuation data that are presented within the Cost of Capital Navigator are used with permission from Morningstar, Inc.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.

Business Valuation Services

Kroll is the largest independent provider of business valuation services.